Post Office saving schemes

Everyone’s investment goals may be different. Everyone expects a maximum return for their hard-earned money. A post office deposit is one of the safest and most profitable investments. Those who use the combination approach in postal saving schemes can achieve maximum returns with minimum capital. Let’s see how it works

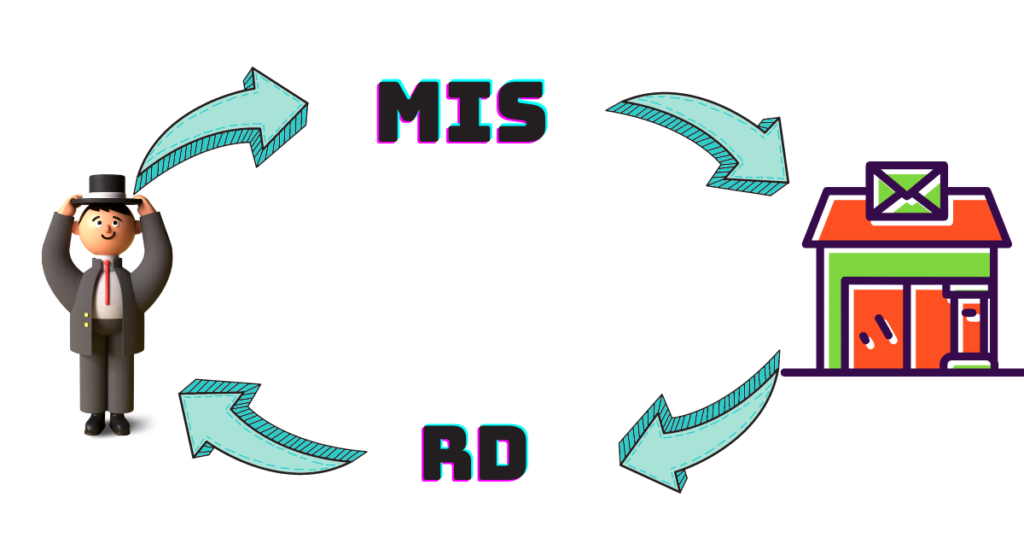

Post office combination approach

Recurring Deposit (RD): Recurring Deposit (RD) is one of the popular schemes in post office saving schemes. The maximum tenure for an RD deposit is 5 years. Interest can be redeemed after the investment period along with the deposited amount. Minimum INR 100/- per month or any amount in multiples of INR 10/-. No maximum limit. From 01.04.2020, interest rates are 5.8 % per annum (quarterly compounded)

Post Office Monthly Income Scheme (MIS): This is the opposite of a recurring investment. It is a system that ensures monthly income for the one-time invested money. Account can be opened with minimum of Rs. 1000 and in multiple of Rs. 1000.The maximum investment limit is INR 4.5 lakh in a single account and INR 9 lakh in a joint account

How combination works

Firstly open the post office MIS scheme. Anyone can start with ann minimum amount of Rs 1000/- month. Maximum up to 4.5 lakhs in a single account. Total investment tenure is 5 years. From 01 Oct 2022 interest rate is 6.7 % per annum payable monthly. For example, if a person invests an amount of 4.5 laks he gets a monthly interest of Rs 2513 if deposits 2 lakhs then he can earn a monthly interest of Rs 1117/-

In our combination method never withdraw the interest earned in MIS deposit and transfer the interest into post office RD.

Post office RD and MIS schemes tenure are 5 years. By investing 2513 monthly after 5 years total the deposit is Rs 1,50,780 and the interest earned is Rs 24370/- After the total maturity amount receivable is Rs 175150/-

These two schemes’ tenure is 5 years so the deposit will mature at the same time it can be withdrawn together. With the combination of this investment method, an investor of Rs 4.50 lakh can withdraw Rs 6,25,150 after five years.